PD = Preference Dividend = 12% of Rs. 100 = Rs.12

RV = Redeemable Value = FV + Premium on redemption = Rs.100 + Rs. 10 = Rs. 110

NP = Face Value / Par Value + Premium on issue – Floatation Cost = 100 + 0 – 4 = Rs. 96

n= Maturity Period =10 years

3. ABC Ltd. has just declared and paid a dividend at the rate of 20 % on the equity share of Rs. 100 each. The expected future growth rate in dividends is 15%. Find out the cost of capital of equity shares given that the present market value of the share is Rs. 170.

Solution

Cost of Equity (Ke) = (D1 / Po) + g

= + 0.15 = 28.53 % = 0.2853

D1 = D0 × (1 + g) = Expected Dividend

D0 = Current Dividend = 20 % of Rs.100 = Rs. 20

g = Growth rate = 15% = .15

P0 = Current Market Price = Rs.170

4. The share of ABC Ltd. is presently traded at Rs. 60 and the company is expected to pay dividends of Rs. 4 per share with a growth rate expected at 10% per annum. It plans to raise fresh equity share capital. The merchant banker has suggested that an underpricing of Rs. 2 is necessary in pricing the new issue besides involving a cost of Re 1 per share on miscellaneous expenses. Find out the cost of existing equity shares as well as the new equity given that the dividend rate and growth rate are not expected to change.

Solution

Cost of existing Equity (Ke) = (D1 / Po) + g

Cost of new Equity (Ke) = (D1 / Po) + g

Net Proceed (NP) = MP (P0) – Underpricing – Miscellaneous expenses = Rs. 60 – Rs. 2 – Re 1 = Rs.57 5.Assuming that the firm pays tax at a 30% rate, compute the after tax cost of capital in the following cases:

(a) A 13.5% preference shares sold at par.

(b) A perpetual bond sold at par, coupon rate being 12.5%.

(c) A ten year 9 % Rs. 1,000 per bond sold at 950.

(d) A common share selling at a market price of Rs. 120 and paying a current dividend of Rs. 10 per share which is expected to grow at a rate of 10 %.

(e) 15 %.Preference Shares of Rs. 100 each, issued at 10 % premium, redeemable at par after 6 years. Flotation cost is Rs. 12 and Dividend Distribution Tax is 20 %. Use both methods.

(f) 12% Debentures of face value of Rs. 1000 each redeemable at par after 5 years, flotation cost being 5%. Use both methods given the tax rate @30%.

Solution

(a) A 13.5% preference shares sold at par.

After tax Cost of Preference Share (Kp) = 13.5 % = 0.135

(b) A perpetual bond sold at par, coupon rate being 12.5%.

After tax Cost of Perpetual Bond (Kd) = Interest rate × (1 – tax rate)

= 12.5 % × (1-0.3) = 0.0875 = 8.75 %

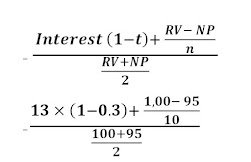

(c) A ten year 9 % Rs. 1,000 per bond sold at 950.

After tax Cost of redeemable Debenture =

= (63 + 5) / 975 = 6.97 % = 0.0697RV = Redeemable Value

NP = Net proceed

I = Interest amount

n = Maturity Period of Debenture / Bond

(d) A common share selling at a market price of Rs. 120 and paying a current dividend of Rs. 10 per share which is expected to grow at a rate of 10 %.

Cost of Equity (Ke) = (D1 / Po) + g

=

D1 = D0 × (1 + g) = Expected Dividend

D0 = Current Dividend

g = Growth rate

P0 = Current Market Price

(e) 15 %.Preference Shares of Rs. 100 each, issued at 10 % premium, redeemable at par after 6 years. Flotation cost is Rs. 12 and Dividend Distribution Tax is 20 %. Use both methods.

After tax Cost of Preference Share Kp =

PD = Preference Dividend = 15

DDT = Dividend Distribution Tax = 20 % of PD = Rs. 3

RV = Redeemable Value = Rs.100

NP = Face Value / Par Value + Premium on issue – Floatation Cost = 100 + 10 – 12 = Rs. 98

n= Maturity Period = 6 years

Second Method: Using Interpolation Method:

NP = PD including DDT × PVAF Kp, 6 + RV × PVFKp, 6

Considering KP at 18 %

= 18 × 3.498 + 100 × 0.37 = Rs. 99.964

Considering KP at 19 %

= 18 × 3.410 + 100 × 0.352 = Rs. 96.58

Now using Interpolation Formula-

(f) 13% Debentures of face value of Rs. 1000 each redeemable at par after 5 years, flotation cost being 5%. Use both methods given the tax rate @30%.

After tax Cost of redeemable Debenture =

= 10.36 % = 0.1036Second Method: Using Interpolation Method:

NP = Interest amount after tax × PVAF Kd, 5 + RV × PVF Kd, 5

Considering KP at 10 %

= 130 × (1- 0.3) × 3.791 + 1,000 × 0.621 = Rs. 965.98

Considering KP at 11 %

= 130 (1-0.3) × 3.696 + 1,000 × 0.593 = Rs. 929.34

Now using Interpolation Formula-

= 10.44 % = .1044

= 10.44 % = .1044

6. RBL Company has the following capital structure on 1 July, 2021

| Number/ Units | Amount (Rs.) |

Equity Shares | 40,000 | 8,00,000 |

11% Preference Shares | | 2,00,000 |

12 % Debentures | | 6,00,000 |

Total | | 16,00,000 |

The share of a company currently sells for Rs. 25. It is expected that the company will pay a dividend of Rs. 2 per share which will grow at 7 % forever. Assume a 40 per cent tax rate; you are required to compute weighted average cost of capital on existing capital structure.

Solution

D1 = Expected Dividend

P0 = Market Price of Equity Share

g = Growth rate

I = Interest rate on Debenture

E = Value of Equity Share

D = Value of Debenture

P = Value of Preference Share

V = Value of Firm = E + D + P

Cost of Equity (Ke) = (D1 / P0) + g = 2/25 + .07 = 0.15 = 15 %

Post Tax Cost of Debt (Kd) = I × (1 - t) = 0.12 × (1-0.4) = 0.072 = 7.2%

Cost of Preference Share (Kp) = 0.11 = 11 %

= 0.075 + 0.027 + 0.01375 = 0.1158 = 11.58%

7. RBL company's share is quoted in the market at Rs. 20 currently. The company has paid dividend of Rs. 2 per share and the investor's market expects a growth rate of 10 percent per year. You are required to compute-

(I) The Company’s Equity Cost of Capital.

(II) If the company's cost of capital is 15 per cent and the anticipated growth rate is 10 per cent per annum, calculate market price if the dividend of Rs. 2 is to be paid at the end of one year.

Solution

I. Cost of Equity (Ke) = (D1 / Po) + g

=

D1 = D0 × (1 + g) = Expected Dividend

D0 = Current Dividend = Rs. 2

g = Growth rate

P0 = Current Market Price

II. Market Price of Share

D1 = Rs. 2 = Expected Dividend

8. Equity shares (Face value of Rs.10 each) of RBL Ltd. are being quoted at PE of 8 times. The retained earnings of the company are Rs. 6 at 40 %.

(I) find out the cost of equity, if the growth rate of the firm is 10%.

(II) Find out the indicated market price of the shares, given that

Ke remains as above and growth rate increases to 13%.

(III) If Ke of the firm is 16% and growth rate being 10%, then what is the indicated market price of the equity share?

Solution

I. Retention ratio = 0.4 = 40 % of EPS = Rs. 6

=> 0.4 EPS = Rs. 6

So, EPS = Rs. 6/0.4 = Rs. 15

Retained Earnings per Share = Rs. 6

EPS = Earnings per Share = E0

MPS = Market Price per Share = P0

PE ratio = MPS / EPS = P0 / E0

MPS = EPS × PE Ratio = Rs. 15 × 8 = Rs. 120

Dividend Payout Ratio = 1 – retention ratio = 1- 0.4 = 0.6 = 60 %

Dividend Per Share (D0) = 60 % of EPS = 0.6 × Rs. 15 = Rs. 9

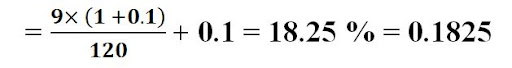

Cost of Equity (Ke) = (D1 / Po) + g

= 18.25 % = 0.1825

D1 = D0 × (1 + g) = Expected Dividend

D0 = Current Dividend = Rs. 9

g = Growth rate

P0 = Current Market Price

II. Market Price of Share (Po)

9. Shares of XYZ Ltd. are currently selling at Rs. 170 each. The company has been regularly paying dividends for last several years as follows:

Years | Amount |

1 | 12.00 |

2 | 12.72 |

3 | 13.48 |

4 | 14.29 |

5 | 15.15 |

6 | 16.07 |

Find out the growth rate of the company, given that the company follows a policy of fixed DP Ratio. Also find out the cost of equity of the company.

Solution

Cumulative Growth rate for 5 years = 16.07 /12.00 = 1.339

In FVF table, the value nearest to 1.339 for 5 years is 1.338 at 6 % rate. So annual growth rate = 6 %

Second way to calculate growth rate in this case is calculating percentage increase in amount year on year since company follows a policy of fixed DP Ratio; hence growth rate will be same Year over Year

Years | Amount | %age Change |

1 | 12.00 | ------- |

2 | 12.72 | (12.72 – 12) /12 = 0.06 or 6 % |

3 | 13.48 | (13.48 - 12.72 ) /12.72 = 0.06 or 6 % |

4 | 14.29 | (14.29 – 13.48) /13.48 = 0.06 or 6 % |

5 | 15.15 | (15.15 – 14.29) /14.29 = 0.06 or 6 % |

6 | 16.07 | (16.07 – 15.15) /15.15 = 0.06 or 6 % |

Cost of Equity (Ke) = (D1 / Po) + g

D0 = Dividend paid in 6th year (since 6th year is current year in which share is trading at Rs. 170)

10. The following figures are taken from the current balance sheet of Diwakar & Co.

Particulars | Amount (Rs.) |

Share Capital of Rs. 10 each | 8,00,000 |

Share / Security Premium | 2,00,000 |

Reserves | 6,00,000 |

Shareholders’ Funds | 16,00,000 |

14 % Perpetual Debentures of Rs. 100 each | 4,00,000 |

An annual ordinary dividend of Rs. 3 per share has just been paid. In the past, ordinary dividends have grown at a rate of 10 per cent per annum and this rate of growth is expected to continue. Annual interest has recently been paid on the debentures. The ordinary shares are currently quoted at Rs. 30 and the debentures at 80 per cent Ignore taxation. You are required to estimate the weighted average cost of capital (based on market values) for Diwakar & Co.

Solution

D0 = Current Dividend paid = Rs. 3

Cost of Equity (Ke) = (D1 / Po) + g

=

Cost of Perpetual Debentures = Interest / NP or MP

= 14/80 = 0.175 = 17.5%

NP = Net Proceed

MP = Market Price of Debenture

Market Value of Equity Share (E) = Market Price per Share × no. of Equity Shares = Rs. 30 × Rs. 8,00,000 / 10 = Rs. 24,00,000.

Market Value of Perpetual Debenture (D) = Market Price per Debenture × no. of Debentures = Rs. 80 × Rs. 4,00,000 / 100 = Rs. 3,20,000.

Market Value of Firm (V) = Market Value of Equity Share + Market Value of Perpetual Debenture = Rs. 24,00,000 + Rs. 3,20,000 = Rs. 27,20,000

WACC (based on market values) = (E/V) × Ke + (D/V) × Kd

= (24,00,000 / 27,20,000) × 0.21 + (3,20,000 / 27,20,000) × 0.175 = 0.185 + 0.021 = 0.206 = 20.6 %

11. The following information has been extracted from the balance sheet of RBL Ltd.

Particulars | Amount (Rs.) |

Share Capital | 5,00,00,000 |

12% Debentures | 5,00,00,000 |

18% Term loan | 12,00,00,000 |

Total | 22,00,00,000 |

(a) Determine the weighted average cost of capital of the company. It had been paying dividends at a consistent rate of 20% per annum. Shares and Debentures are being traded at par. Tax rate is 40%.

(b) What difference will it make if the current price of share (Face Value Rs.100) is Rs. 170?

Solution

a. Cost of Debenture (Kd) = I (1- t)

= 12% × (1-0.4) = 7.2% = 0.072

Cost of Term Loan (KL) = I (1-t)

=18% × (1-0.4) = 10.8% = 0.108

Cost of equity (Ke) = Dividend / NP or P0 = 20 / 100 = 0.2

(Assuming Par value of Equity share to be Rs. 100; Dividend = 20 % of Face value = 20 % of Rs. 100)

Note: Since Market Price of Share and growth rate is not given and there is no premium or discount on issue of share and also no floatation cost is mentioned in the question, hence face value / Par value has been considered as Net proceed or Market Price of equity Share.

WACC = (E/V) × Ke + (D/V) × Kd + (TL / V) × KL

= (5,00,00,000 / 22,00,00,000) × 0.2 + (5,00,00,000 / 22,00,00,000) × 0.072 + (12,00,00,000 / 22,00,00,000) × 0.108

=0.045 + 0.0163 +0.0589 = 0.1202 = 12.02%

b. Cost of equity (Ke) = Dividend / P0 = 20 / 170 = 0.1176

Cost of Term Loan (KL) and Cost of Debenture (Kd) will remain same.

WACC (based on Book Value of company) = (E/V) × Ke + (D/V) × Kd + (TL / V) × KL

= (5,00,00,000 / 22,00,00,000) × 0.1176 + (5,00,00,000 / 22,00,00,000) × 0.072 + (12,00,00,000 / 22,00,00,000) × 0.108

=0.027 + 0.0163 +0.0589 = 0.102 = 10.2%

12. The following information is available from the Balance Sheet of a Company:

Particulars | Amount (Rs.) |

Share Capital- 20,000 shares of Rs. 10 each | 2,00,000 |

Reserve & Surplus | 1,40,000 |

8 % Debentures | 1,60,000 |

The rate of tax for the company is 50%. Current level of Equity Dividend is 15%. Calculate the weighted average cost of capital using the above figures.

Solution

| Book Value | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Equity Share Capital | 2,00,000 | 2,00,000/5,00,000 = 0.4 | .15 | 0.06 |

Reserve & Surplus | 1,40,000 | 1,40,000/5,00,000 = 0.28 | .15 | 0.042 |

8 % Debentures | 1,60,000 | 1,60,000/5,00,000 = 0.32 | 0.08 × (1-0.5) =0.04 | 0.0128 |

Total Value of Firm | 4,00,000 | WACC based on Book Value = ∑ Weighted Cost= 0.06 + 0.042 + 0.0128 = 0.1148 |

13. In considering the most desirable capital structure for a company, the following estimates of the cost of debt capital (after tax) have been made at various levels of debt-equity mix:

Debt as percentage of Total Capital Employed | Cost of Debt (Kd) % | Cost of Equity (Ke )% |

0 | 7.0 | 20.0 |

10 | 7.0 | 20.0 |

20 | 7.0 | 20.5 |

30 | 7.5 | 21.0 |

40 | 8.0 | 22.0 |

50 | 8.5 | 25.0 |

60 | 9.5 | 27.0 |

You are required to find out the weighted average cost of capital of the firm for different proportions of debt and optimal capital structure.

Solution

Debt % | Kd | Equity % | Ke | WACC = (Debt % × Kd) +( Equity %× Ke) |

| | | | |

0 | 7.0 | 100 | 20.0 | 20% |

10 | 7.0 | 90 | 20.0 | 18.7% |

20 | 7.0 | 80 | 20.5 | 17.8% |

30 | 7.5 | 70 | 21.0 | 16.95% |

40 | 8.0 | 60 | 22.0 | 16.4% |

50 | 8.5 | 50 | 25.0 | 16.75% |

60 | 9.5 | 40 | 27.0 | 16.5% |

Since WACC is lowest with 40 % debt and 60 % equity. Hence, optimal capital Structure will be capital mix of 40:60 Debt- equity ratio.

Since value of debt and equity is given in percentage, there is no need to calculate weight of Debt and equity for WACC calculation as it will remain same. Since value of firm will be 100 % and if we divide debt % with firm value percentage or equity % with firm value percentage, result will remain same.

14. A company with net operating income of Rs. 3, 00,000 is attempting to evaluate a number of possible capital structures, given below. Which of the capital structure will you recommend and why?

Capital Structure | Debt in Capital Structure (Rs.) | Kd (Cost of Debt) | Ke (Cost of Equity) |

1 | 1,00,000 | 10.0 | 12.0 |

2 | 2,00,000 | 10.0 | 12.0 |

3 | 3,00,000 | 10.0 | 12.0 |

4 | 4,00,000 | 10.0 | 12.5 |

5 | 5,00,000 | 11.0 | 13.5 |

6 | 6,00,000 | 12.0 | 15.0 |

7 | 7,00,000 | 14.0 | 18.0 |

Solution

Capital Structure | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

EBIT | 3,00,000 | 3,00,000 | 3,00,000 | 3,00,000 | 3,00,000 | 3,00,000 | 3,00,000 |

Less: Interest | (10,000) | (20,000) | (30,000) | (40,000) | (55,000) | (72,000) | (98,000) |

EBT / PAT | 2,90,000 | 2,80,000 | 2,70,000 | 2,60,000 | 2,45,000 | 2,28,000 | 2,02,000 |

Ke | 12.0 | 12.0 | 12.0 | 12.5 | 13.5 | 15.0 | 18.0 |

Value of Equity | 24,16,667 | 23,33,333 | 22,50,000 | 20,80,000 | 18,14,815 | 15,20,000 | 11,22,222 |

Value of Debt | 1,00,000 | 2,00,000 | 3,00,000 | 4,00,000 | 5,00,000 | 6,00,000 | 7,00,000 |

Value of Firm | 25,16,667 | 25,33,333 | 25,50,000 | 24,80,000 | 23,14,815 | 21,20,000 | 18,22,220 |

Value of Equity = PAT / Ke

Value of Firm = Value of Debt + Value of Equity

Since, Value of Firm is highest for third Capital structure; hence third capital structure should be selected by company.

15. POR & Co. has the following capital structure as on Dec. 31.

Particulars | Amount (Rs.) |

Share Capital- 5,000 shares of Rs. 100 each | 5,00,000 |

9 % Preference Shares | 2,00,000 |

10 % Debentures | 3,00,000 |

The equity shares of the company are quoted at Rs. 110 and the company is expected to declare a dividend of Rs. 10 per share for the next year. The company has registered a dividend growth rate of 5% which is expected to be maintained.

(I) Assuming the tax rate applicable to the company at 40%, calculate the weighted average cost of capital, and

(II) Assuming that the company can raise additional term loan at 12% for Rs. 10,00,000 to finance its expansion, calculate the revised WACC. The company's expectation is that the business risk associated with new financing may bring down the market price from Rs. 110 to Rs. 90 per share.

Solution

I. Cost of Equity (Ke) = (D1 / Po) + g

Post TaxCost of Debenture (Kd) = I × (1-t) = 0.1 × (1-0.4) =0.06 = 6 %

Cost of Preference Share (Kp) = 0.09 = 9%

| Book Value | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Equity Share Capital | 5,00,000 | 5,00,000/10,00,000 = 0.5 | .141 | 0.0705 |

9 % Preference Shares | 2,00,000 | 2,00,000/10,00,000 = 0.20 | .09 | 0.018 |

10 % Debentures | 3,00,000 | 3,00,000/10,00,000 = 0.30 | .06 | 0.018 |

Total Value of Firm | 20,00,000 | WACC based on Book Value = ∑ Weighted Cost= 0.0705 + 0.018 + 0.018 = 0.1065 = 10.65% |

II. Cost of Term Loan (Kl) = I × (1- t) = .12 × .6 = 0.072 = 7.2%

Cost of Equity (Ke) = (D1 / Po) + g

| Book Value | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Equity Share Capital | 5,00,000 | 5,00,000/20,00,000 = 0.25 | .1611 | 0.0403 |

9 % Preference Shares | 2,00,000 | 2,00,000/20,00,000 = 0.10 | .09 | 0.018 |

10 % Debentures | 3,00,000 | 3,00,000/20,00,000 = 0.15 | .06 | 0.018 |

12 % Term Loan | 10,00,000 | 10,00,000/20,00,000 = 0.5 | 0.072 | 0.036 |

Total Value of Firm | 10,00,000 | WACC based on Book Value = ∑ Weighted Cost= 0.0403 + 0.018 + 0.018 + 0.036= 0.1123 = 11.23% |

16. International Foods Limited has the following capital structure:

Particulars | Book Value (Rs.) | Market Value (Rs) |

| | |

Share Capital- 25,000 shares of Rs. 10 each | 2,50,000 | 4,50,000 |

13% Preference Capital (500 shares of Rs. 100 each) | 50,000 | 45,000 |

Reserves and Surplus | 1,50,000 | ---------- |

12 % Debentures (1500 debentures of 100 each) | 1,50,000 | 1,20,000 |

Total | 6,00,000 | 6,15,000 |

The expected dividend per share is Rs.2 and the dividend per share is expected to grow at a rate of 10 percent forever. Preference shares are redeemable after 5 years at par whereas debentures are redeemable after 10 years at 10 % premium. The tax rate for the company is 30 per cent. You are required to compute the weighted average cost of capital for the existing capital structure using market value as weights.

Solution

Cost of Equity (Ke) = (D1 / Po) + g

0.2111 = 21.11 %

D1 = Expected Dividend

g = Growth rate

P0 = Current Market Price

P0 = Market Value (MV) of Equity / Total no. of Equity Shares = Rs. 4,50,000 / 25,000 = Rs. 18

After tax Cost of Preference Share Kp =

PD = Preference Dividend = 13

RV = Redeemable Value = Rs.100

MP = Market Price

n= Maturity Period = 5 years

MP = Market Value of Pref. Share / Total no. of Pref. Shares

= Rs. 45,000 / 500 = Rs. 90

After tax Cost of redeemable Debenture =

RV = Redeemable Value = Par value + Premium on redemption = Rs. 100 + 10 % of Rs. 100 = Rs. 110

I = Interest amount

n = Maturity Period of Debenture / Bond = 10 years

MP = Market Price

MP = Market Value of Debentures / Total no. of Debentures

= Rs. 1,20,000 / 1,500 = Rs. 80

| Market Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 4,50,000 | 4,50,000/6,15,000 = 0.732 | 0.2111 | 0.1545 |

13% Preference Capital | 45,000 | 45,000/6,15,000 = 0.0732 | .1579 | 0.0116 |

Reserves and Surplus | ________ | __________ | ___ | ____ |

12 % Debentures | 1,20,000 | 1,20,000/6,15,000 = 0.1951 | 0.12 | 0.0234 |

Total | 6,15,000 | WACC based on Market Value = ∑ Weighted Cost= 0.1545 + 0.0116+ 0.0234 = 0.1895 = 18.95% |

Note: While calculating WACC based on Market value, Reserve & Surplus and Retained earnings are not considered as it is absorbed in market value of equity share. Alternatively we can divide market value of Equity shares in the ratio of book value of Equity Share and Reserve & Surplus and then include Market value of Reserve & Surplus while calculating WACC based on Market value. In this case,

Cost of Reserve & Surplus (KR&S) = Cost of Share Capital (Ke)

In this case Market value of Equity that is Rs. 4,50,000 can be divided into Equity Share & Reserve & Surplus in the ration of book value of Equity Share & Reserve & Surplus That is in the ratio of 2,50,000 : 1,50,000.

| Market Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 2,81,250 | 2,81,250/6,15,000 = 0.4573 | 0.2111 | 0.0965 |

13% Preference Capital | 45,000 | 45,000/6,15,000 = 0.0732 | .1579 | 0.0116 |

Reserves and Surplus | 1,68,750 | 1,68,750/6,15,000 = 0.2744 | 0.2111 | 0.058 |

12 % Debentures | 1,20,000 | 1,20,000/6,15,000 = 0.1951 | 0.12 | 0.0234 |

Total | 6,15,000 | WACC based on Market Value = ∑ Weighted Cost= 0.0965 + 0.0116 + 0.058 + 0.0234 = 0.1895 = 18.95% |

17. A Limited has the following capital structure:

Particulars | Amount (Rs.) |

Share Capital- 2,00,000 shares of Rs. 20 each | 40,00,000 |

6 % Preference Shares | 10,00,000 |

8 % Debentures | 30,00,000 |

The market price of the company's equity share is Rs. 30. It is expected that company will pay a dividend of Rs. 2 per share at the end of current year, which will grow at 10 per cent forever. The tax rate is 30 per cent. You are required to compute the following:

(a) A weighted average cost of capital based on existing capital structure.

(b) The new weighted average cost of capital if the company raises an additional Rs. 20,00,000 debt by issuing 12 % debentures. This would result in increasing the expected dividend to Rs. 3 and leave the growth rate unchanged but the price of share will fall to Rs. 20 per share.

(c) The cost of capital if in (b) above, growth rate increases to 12 percent.

Solution

a. Cost of Equity (Ke) = (D1 / Po) + g

D1 = Expected Dividend

g = Growth rate

P0 = Current Market Price

Post Tax Cost of Debenture (Kd) = Interest rate × (1 - t)

= 0.08 × (1 - 0.3) = 0.056 = 5.6%

Cost of Preference Share (KP) = 6% = 0.06

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 40,00,000 | 40,00,000 / 80,00,000 =0.5 | 0.1667 | 0.0834 |

6% Preference Capital | 10,00,000 | 10,00,000 / 80,00,000 = 0.125 | .06 | .0075 |

8 % Debentures | 30,00,000 | 30,00,000 / 80,00,000 =0.375 | 0.056 | .0210 |

Total | 80,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.0834 + 0.0075 + 0.0210 = 0.1119 = 11.19 % |

b. Cost of Equity (Ke) = (D1 / Po) + g

Post Tax Cost of 12 % Debentures (Kd) = Interest rate × (1 - t)

= 0.12 × (1 - 0.3) = 0.084 = 8.4 %

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 40,00,000 | 40,00,000 / 1,00,00,000=0.4 | 0.25 | 0.1 |

6% Preference Capital | 10,00,000 | 10,00,000 / 1,00,00,000= 0.1 | .06 | 0.006 |

8 % Debentures | 30,00,000 | 30,00,000 / 1,00,00,000=0.3 | 0.056 | 0.017 |

12 % Debentures | 20,00,000 | 20,00,000 / 1,00,00,000 = 0.2 | 0.084 | 0.017 |

Total | 1,00,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.1 + 0.006 + 0.017 + 0.017 = 0.14 = 14 % |

c. Cost of Equity (Ke) = (D1 / Po) + g

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 40,00,000 | 40,00,000 / 1,00,00,000=0.4 | 0.27 | 0.108 |

6% Preference Capital | 10,00,000 | 10,00,000 / 1,00,00,000= 0.1 | .06 | 0.006 |

8 % Debentures | 30,00,000 | 30,00,000 / 1,00,00,000=0.3 | 0.056 | 0.017 |

12 % Debentures | 20,00,000 | 20,00,000 / 1,00,00,000 = 0.2 | 0.084 | 0.017 |

Total | 1,00,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.108 + 0.006 + 0.017 + 0.017 = 0.148 = 14.8 % |

18. An electric equipment manufacturing company wishes to determine the weighted average cost of capital for evaluating capital budgeting projects. You have been supplied with the following information:

Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

Equity share capital | 12,00,000 | Fixed Assets | 25,00,000 |

Pref. share capital | 4,50,000 | Current Assets | 15,00,000 |

Retained Earnings | 4,50,000 | | |

Debentures | 9,00,000 | | |

Current Liabilities | 10,00,000 | | |

| 40,00,000 | | 40,00,000 |

Additional Information:

(a) 10 years 10% Debentures of 2,500 face value, redeemable at 5% premium can be sold at par. 2% Flotation costs.

(b) 12% Preference shares: Sale price Rs. 100 per share, 2% Flotation costs.

(c) Equity shares: Sale price Rs. 120 per share, Flotation costs- Rs. 5 per share.

The corporate tax rate is 40% and the expected growth in equity dividend is 10 % per year. The expected dividend at the end of the current financial year is Rs.10 per share. Assume that the company is satisfied with its present capital structure and intends to maintain it.

Solution

Cost of Equity (Ke) = (D1 / NP) + g

NP = Sales Price – Floatation Cost = Rs.120 – Rs.5 = Rs.115

After tax Cost of redeemable Debenture =

RV = Face Value + 5 % Premium on redemption

= Rs. 2,500 + Rs.125 = Rs.2,625

NP = Face Value – Floatation cost = Rs.2500 – 2 % of Rs.2500 = Rs.2,450

Cost of Irredeemable Preference Share (Kp) = PD / NP

= 12/98 = 0.1224 = 12.24%

NP = NP = Face Value – Floatation cost = Rs. 100 – 2 = Rs.98

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 12,00,000 | 12,00,000/30,00,000= 0.4 | 0.187 | .0748 |

Retained Earnings | 4,50,000 | 4,50,000/30,00,000 =.15 | 0.187 | .0281 |

12% Preference Capital | 4,50,000 | 4,50,000/30,00,000 =.15 | 0.1224 | .0183 |

10 % Debentures | 9,00,000 | 9,00,000/30,00,000 =0.3 | 0.076 | .0228 |

Total | 30,00,000 | WACC based on Book Value = ∑ Weighted Cost =.0748+.0281+.0183+.0228= .1212 = 12.12% |

19. The latest Balance Sheet of RBL Ltd. is given below:

Particulars | Amount (Rs.) |

Share Capital- 50,000 shares of Rs. 10 each | 5,00,000 |

Security Premium | 1,00,000 |

Retained Profit | 6,00,000 |

10 % Preference Shares – 16,000 shares | 4,00,000 |

15 % Perpetual Debt – 6000 debentures | 6,00,000 |

The ordinary shares are currently priced at Rs. 40 ex-dividend each and Rs.25 preference share is priced at Rs. 25 cum-dividend. The debentures are selling at 110 per cent ex-interest and tax is paid by RBL Ltd. at 40 per cent. RBL Ltd's cost of equity has been estimated at 20 per cent. Calculate the weighted average cost of capital (based on market value) WACC of D Ltd.

Solution

Ke = .20

Cost of Perpetual debt (Kd) =

=0.082

Cost of Irredeemable Preference Share (Kp) = PD / NP

= 2.5 / (25 – 2.5) = 0.1111

Note: Since Price of Preference share is including dividend that is cum dividend as given in the question, hence dividend has been subtracted from Market Price.

| Market Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 40×50,000 = 20,00,000 | 0.6623 | 0.2 | .1325 |

10% Preference Capital | 22.5 × 16,000 =3,60,000 | .1192 | 0.1111 | .0132 |

15 % Debentures | 110×6,000=6,60,000 | .2185 | 0.082 | .018 |

Total | 30,20,000 | WACC based on Market Value = ∑ Weighted Cost =.1325+.0132+ .018 = .1637 =16.37% |

20. Determine the weighted average cost of capital using (a) book value weights; and (b) market value weights based on the following information:

Book value structure | Amount (Rs.) |

Share Capital- 1,00,000 shares of Rs. 10 each | 10,00,000 |

Preference shares (2,000 Pref. Shares of Rs.100 each) | 2,00,000 |

Debentures ( 8,000 units of Rs.100 each) | 8,00,000 |

Total | 20,00,000 |

Recent market prices of all these securities are: Debentures: Rs. 110 per Debenture; Preference shares: Rs. 120 per share and Equity shares: Rs. 22 per share. External financing opportunities are:

(i) Rs. 100 per Debenture redeemable at par, 10 year maturity, 13% coupon rate, 4% flotation cost and sale price Rs. 100;

(ii) Rs. 100 per Preference Share redeemable at par, 10 year maturity, 14% dividend rate, 5% flotation cost and sale price 100; and

(iii) Equity shares: Rs. 2 per share flotation costs and sale price Rs. 22.

Dividend expected on equity shares at the end of the year is Rs. 2 per share; anticipated growth rate in dividends is 7%. Company pays all its earnings in the form of dividends. Corporate tax rate is 30%.

Solution

a. Cost of Equity (Ke) = (D1 / NP) + g

0.17 = 17 %

NP = Sales Price – Floatation Cost = Rs.22 – Rs.2 = Rs.20

After tax Cost of redeemable Debenture =

NP = Face Value – Floatation cost = Rs.100 – 4 % of Rs.100 = Rs. 96

After tax Cost of Preference Share Kp =

=

NP = Sales Price – Floatation Cost = Rs.100 – Rs.5 = Rs.95

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 10,00,000 | 10,00,000/ 20,00,000 = 0.5 | .17 | 0.085 |

14% Preference Capital | 2,00,000 | 2,00,000/ 20,00,000 =.1 | .149 | 0.0149 |

13 % Debentures | 8,00,000 | 8,00,000/ 20,00,000 =.4 | .097 | 0.0388 |

Total | 20,00,000 | WACC based on Book Value = ∑ Weighted Cost =.085+.0149+.0388 =.1387 = 13.87% |

b.

| Market Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 22 × 1,00,000 =22,00,000 | .6627 | .17 | .1127 |

10% Preference Capital | 120 × 2,000 = 2,40,000 | .0723 | .149 | .0108 |

15 % Debentures | 110 × 8,000 = 8,80,000 | .2650 | .097 | .0258 |

Total | 33,20,000 | WACC based on Market Value = ∑ Weighted Cost =.1127+.0108+ .0258= .1493 =14.93% |

21. The following information is provided in respect of the specific cost of capital of different sources along with the book value (BV) and market value (MV) weights.

Source | Cost of Capital (%) | Book Value | Market Value |

Equity share capital | 20 | .5 | .55 |

Preference shares | 15 | .2 | .20 |

Debenture | 10 | .3 | .25 |

(a) Calculate the Weighted Average Cost of Capital, WACC, using both the BV and the MV weights.

(b) Calculate the WMCC using marginal weights given that the company intends to raise additional funds using 50 % long term debts, 30% preference share and 20% by retaining profits.

Solution

Source | Cost of Capital (COC) | Book Value (BV) | Market Value (MV) | BV × COC | MV ×COC |

Equity share capital | .20 | .5 | .55 | .1 | .11 |

Preference shares | .15 | .2 | .20 | .03 | .03 |

Debenture | .10 | .3 | .25 | .03 | .025 |

| | | | WACC based on BV =.16 = 16% | WACC based on MV=.175 = 16.5% |

Source | Cost of Capital (COC) | Weight | Weighted Cost = Weight × COC |

Retained Earnings | .20 | .2 | .04 |

Preference shares | .15 | .3 | .045 |

Debenture | .10 | .5 | .05 |

| WMCC = ∑ Weighted Cost = .135=13.5% |

22. X Ltd. has assets of Rs. 32,00,000 that have been financed by Rs. 18,00,000 of equity shares (of Rs. 100 each), General Reserve of Rs. 4,00,000 and Debt of Rs. 10,00,000. For the year ended 31-3-2021, the company's total profits before interest and taxes were Rs. 6, 50,000. X Ltd. pays 10 % interest on borrowed capital and is in a 30% tax bracket. The market value of equity as on 31-3-2021 was Rs.150 per share. What was the weighted average cost of capital? Use market values as weights.

Solution

Cost of debt (Kd) = Interest rate × (1 – t) = .1 ×.7 = .07 = 7 %

Cost of Equity (Ke) = PAT / MV of Equity

= 3,85,000 / 27,00,000 = 0.1426 = 14.26 %

PAT = (EBIT – Interest) × (1 – t) = (6,50,000 – 1,00,000) ×.7

= 3,85,000

MV of Equity Share = MP of Share × no. of Equity Shares

= Rs.27,00,000

| Market Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Equity Share Capital | 27,00,000 | 27,00,000/37,00,000 = .73 | .1426 | .1041 |

Debt | 10,00,000 | 10,00,000/37,00,000 = .27 | .07 | .0189 |

Total | 37,00,000 | WACC based on Market Value = ∑ Weighted Cost = .123 = 12.3% |

23. The following is the capital structure of Simons Company Ltd-

Particulars | Amount (Rs.) |

Share Capital- 10,000 shares of Rs. 100 each | 10,00,000 |

12 % Preference Shares of Rs. 100 each | 4,00,000 |

10 % Debentures | 6,00,000 |

The market price of the company's share is Rs. 120 and it is expected that a dividend of Rs. 10 per share would be declared after 1 year. The dividend growth rate is 10%:

(i) If the company is in the 40% Tax bracket, compute weighted average cost of capital.

(ii) Assuming that in order to finance an expansion plan, the Company intends to borrow a fund of Rs.10 lacs bearing 12% rate of interest, what will be the company’s revised weighted average cost of capital? This financing is expected to increase dividend from Rs. 10 to Rs. 12 per share. However, the market price of equity share is expected to decline from Rs. 120 to Rs. 110 per share.

Solution

i. Cost of Equity (Ke) = (D1 / MP) + g

Cost of Pref. Share (Kp) = 0.12

Cost of Debt (Kd) = I × (1 - t) = .1 × (1 – 0.4) = 0.06 = 6%

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 10,00,000 | 10,00,000/ 20,00,000 = 0.5 | .1833 | 0.092 |

12% Preference Capital | 4,00,000 | 4,00,000/ 20,00,000 =.2 | .12 | 0.024 |

10 % Debentures | 6,00,000 | 6,00,000/ 20,00,000 =.3 | .06 | 0.018 |

Total | 20,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.092 + 0.024 + 0.018 = 0.116 = 11.6 % |

ii. Cost of Equity (Ke) = (D1 / MP) + g

Cost of Pref. Share (Kp) = 0.12

Cost of Debt (Kd) = I × (1 - t) = .1 × (1 – 0.4) = 0.06 = 6%

Cost of Loan / Borrowed Fund (KL) = I × (1 - t) = .12 × (1 – 0.4) = 0.072 = 7.2%

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 10,00,000 | 10,00,000/ 30,00,000 = 0.333 | .2091 | 0.07 |

12% Preference Capital | 4,00,000 | 4,00,000/ 30,00,000 =.1333 | .12 | 0.016 |

10 % Debentures | 6,00,000 | 6,00,000/ 30,00,000 =.2 | .06 | .012 |

12 % Borrowed Funds | 10,00,000 | 10,00,000/ 30,00,000 = 0.333 | .072 | .024 |

Total | 30,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.07+0.016+.012 + .024 = .122 = 12.2% |

24. XYZ Ltd wishes to raise additional funds of Rs.10,00,000 to take up an investment proposal. Following information is provided:

| |

Retained Earnings | 2,50,000 |

Earnings Per share | 5 |

Dividend Payout Ratio | 60% |

Expected Growth Rate | 10% |

Current Market Price of Share | 30 |

Debt- Equity Mix | 30%:70% |

Cost of Debts (before tax): Funds up to Rs. 2,00,000 Funds More than 2,00,000 | 10% 12% |

Tax Rate | 40% |

You are required to:

(i) Determine the pattern for raising additional funds.

(ii) Determine the Cost of Equity and Cost of Retained Earnings.

(iii) Determine the Required Rate of Return for the new Project.

Solution

i. Debt to be raised – 30 % = Rs. 3,00,000

Equity – 70% = Rs. 7,00,000

Retained Earnings (2,50,000)

Equity fund to be raised = Proportion of Equity amount – Retained Earnings

= Rs. 7,00,000 – Rs. 2,50,000 = Rs. 4,50,000

After tax Cost of Debt (Kd) = I × (1- t) = .12 × (1- 0.4) = .072 = 7.2%

ii. Cost of Equity (Ke) = Cost of Retained Earnings (KRE)

= (D1 / MP) + g

Current Dividend (D0) = Rs. 3

Expected Dividend (D1) = D0 (1 + g) = Rs. 3 × 1.1 = Rs.3.3

Dividend Payout Ratio = 60 % of EPS = 60 % of Rs.5 = Rs. 3

iii.

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital including Retained Earnings | 7,00,000 | 7,00,000/ 10,00,000 = 0.7 | 0.21 | 0.147 |

12 % Debentures | 3,00,000 | 3,00,000/ 10,00,000 =.3 | .072 | 0.0216 |

Total | 10,00,000 | WACC = ∑ Weighted Cost = 0.147+ 0.0216 = 0.1686 = 16.86 % |

25. ABC company has the following capital structure and is considered to be an optimum.

Particulars | Amount (Rs.) |

Share Capital- 1,00,000 shares | 16,00,000 |

15 % Preference Shares | 1,00,000 |

20 % Debentures | 3,00,000 |

| 20,00,000 |

The company has paid a dividend of Rs. 4 with a growth rate of 10%. The company's share has a current market price of Rs. 20 per share. The expected dividend per share next year is 50% of the dividend for the current year. 20 % new debentures can be issued by the company. The company's debentures are currently selling at Rs. 98 per debenture. 15 % preference share can be sold at a net price of Rs. 9.5 (face value Rs. 10 each). The company's tax rate is 30%.

(a) Calculate after tax cost of (i) Debt, (ii) Preference share capital and (iii) Equity shares

(b) Also calculate Weighted Average Cost of Capital, WACC.

Solution

After tax cost of new Debt (Kd) =

After tax cost of Pref. Share (KP) = = 1.5 / 9.5 = 0.158 = 15.8%

Cost of Equity (Ke) = (D1 / MP) + g

D1 = 50 % of D0 = 50 % of Rs.4 = Rs. 2

| Book Value (Rs) | Weight | After Tax Cost | Weighted Cost = Weight × After Tax Cost |

Share Capital | 16,00,000 | 16,00,000/ 20,00,000 = 0.8 | 0.20 | 0.16 |

15 % Preference Shares | 1,00,000 | 1,00,000/ 20,00,000 =.05 | .158 | 0.008 |

20 % Debentures | 3,00,000 | 3,00,000/ 20,00,000 =.15 | .1429 | .0214 |

| 20,00,000 | WACC based on Book Value = ∑ Weighted Cost = 0.16 + 0.008 + .0214 = .1894 = 18.94 % |

26. RBL & Co. wishes to find out its weighted marginal cost of capital, WMCC, based on target capital structure proportions. Using the data given below, find out the WMCC.

Source | Proportion | Range | Cost |

Equity share capital | 50% | Up to Rs. 3,00,000 3,00,000-7,50,000 7,50,000 and above | 13.00% 13.5% 15.5% |

Preference shares | 10% | Up to 1,00,000 1,00,000 and above | 10 % 11% |

Long term debt | 40% | Up to Rs. 4,00,000 4,00,000-8,00,000 8,00,000 and above | 6 % 6.50% 7 % |

Solution

Source | Prop. | Range | Cost | Breaking Points |

E. Share | .5 | Up to Rs. 3,00,000 3,00,000-7,50,000 7,50,000 and above | 13.00% 13.5% 15.5% | 3 L /.5=6 L 7.5 L /.5=15L-------------- |

P. Share | .1 | Up to 1,00,000 1,00,000 and above | 10 % 11% | 1 L / .1 = 10 L -------------- |

L.T. Debt | .4 | Up to Rs. 4,00,000 4,00,000-8,00,000 8,00,000 and above | 6 % 6.50% 7 % | 4 L / .4 = 10L 8 L / .4 = 20 L --------------- |

Range | Source | Prop. | cost | Weighted Cost = Weight × After Tax Cost |

Up to 6 L | E. Share P. Share L T Debt | .5 .1 .4 | .13 .1 .06 | .065 .01 .024 WMCC=.099 |

6 L – 10 L | E. Share P. Share L T Debt | .5 .1 .4 | .135 .1 .06 | .0675 .01 .024 WMCC=.1015 |

10 L – 15 L | E. Share P. Share L T Debt | .5 .1 .4 | .135 .11 .065 | .0675 .011 .026 WMCC=.1045 |

15 L – 20 L | E. Share P. Share L T Debt | .5 .1 .4 | .155 .11 .065 | .0775 .011 .026 WMCC=.1145 |

20 L & above | E. Share P. Share L T Debt | .5 .1 .4 | .155 .11 .07 | .0775 .011 .028 WMCC=.1165 |

Links to Financial Management notes: -

Time Value of Money

https://gyanvikalpa.blogspot.com/2021/06/time-value-of-money-solved-problems-pdf.html

Leverage Analysis

https://gyanvikalpa.blogspot.com/2021/08/financial-management-notes-leverage.html

Cost of Capital

https://gyanvikalpa.blogspot.com/2021/08/cost-of-capital-solved-problems.html

EBIT – EPS Analysis

https://gyanvikalpa.blogspot.com/2021/08/ebit-eps-analysis-financial-break-even.html

Capital Structure Analysis

https://gyanvikalpa.blogspot.com/2022/02/capital-structure-theories-and-solved.html

Estimation of Cash Flow in Capital Budgeting

https://gyanvikalpa.blogspot.com/2021/06/cash-flow-estimation-in-capital.html

Techniques of Capital Budgeting

https://gyanvikalpa.blogspot.com/2021/06/techniques-of-capital-budgeting-solved.html